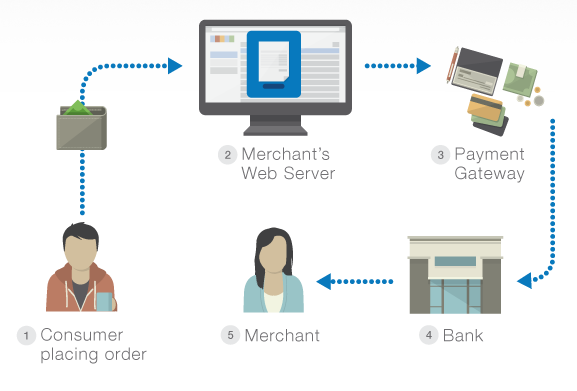

The Payment Facilitators (PF) or a Payment Service Provider (PSP) process the payments by operating their software. The software that should keep almost every data of the PF, logs every movement of users, handles every flow & algorithm and process calculates everything.

In this post, I will try to explain how to develop them and give some tutorials based on my own experiences with them.

A PF/PSP software is naturally expected to be able to manage accounts, financial sources, reporting, keeping every movement in databases/logs and realize the integrations within external financial services like card networks, banks, fraud services, merchants and more.

By the point, it sounds like it is a typical business software and that encouraging any developer team which has hands-on experience within a similar business software projects can easily handle it. But unfortunately, it’s more complicated than it seems.

Now, before I start to explain why it is not what it looks like here, let me highlight that:

“A fin-tech project is more than a software development project. ”

Fin-tech is a multi-discipline field, synthesizes knowledge and experience of both finance and IT.

As we know that a classical software development project has 4 main items in a checklist.

- UI/UX (design, appearance, front-end, or whatever you call )

- Performance

- Security

- Functionality

But if the subject is a PF/PSP software; in other words, if it is a fin-tech project, it should be developed while bearing in mind the additional items and checklist that comes from finance/banking/e-commerce. The majors of these items are

- Compatibility with financial&technical standards like PCI-DSS

- Able to get validations by independent audits

- Compatibility with financial and trade legislation

PCI-DSS

The PCI-DSS (Payment Card Industry Security Standards Council) is an organization publishes the standards which cover all the bases of payment processing from the network architecture to software UI. The PF/PSP software (and the whole system operates within) has to be approved by a PCI-DSS audit. Once a PF/PSP has the PCI-DSS compatibility badge, it is now responsible to sustain that compatibility and audit reports periodically, forever.

Security

By the nature of financial services, security is an extremely important point. Late discovery moreover fixing a security hole lately in a financial system can mean a “knockout” for the whole corporation.

As the engineers know, there is a border between security and functionality. If you widen the security, you will face with the low functionality. In other words, the more functions the more security concerns. This norm may valid for all software projects. But in terms of fin-tech, we have no flexibility in security regulation and we have to keep all functions as possible.

Financial Regulations

Since the software will be a part of a business organization and flow, it will be a subject in financial audits too. That means some checklists which mentioned the software and contain tons of banking business regulations. By this time, starting over may be easier than fix the software if it has been developed without paying attention to banking/financial legislation and regulations.

Despite the financial/banking regulations have no direct links within technical specifications, some of them touches even the main algorithm of software. If you are familiar with software developing you know what it means to change anything in the system core.

Performance

In addition to these, a PF/PSP system has been integrated with

different external financial systems like banks, gateways of other PSP and PF systems, in more common words the APIs.

Unfortunately, each of them has different API architectures, data structures, and protocols. But the point is not how hard are those integrations. It is performance.

The spending time per processing a payment is the most important criterion for profit. Most of the cases, PF/PSP companies process billions of transactions with micro profit rates. Other hand, their systems have some costs per time at data-centers. Another case; some financial services provides some rapidly changing data like the exchange rates of currencies. In such cases, the process has to be completed less than seconds. Otherwise, the results are loss or errors.

In a nutshell

Not only PF/PSP software but also anything in the fin-tech ecosystem should develop under the wing of fin-tech experts. Fin-tech is not a newborn industry. But is not as old as IT that a qualified specialist easily can be found.

If you are about starting a project, you need at least one consultant who has experienced a similar fin-tech project.

I strongly recommend that the best and the most cost-effective way is working with a company during your project as a partner like EticSoft